Have you ever sent money using the Zelle payment app and instantly wished you could take it back? You’re not alone. Millions use Zelle every day because it’s fast but that same speed makes canceling a payment almost impossible once it’s gone.

In this guide, you’ll discover exactly when you can cancel a Zelle payment, how your Zelle payment limit works, and practical steps to keep your Zelle account safe.

Why Zelle Payments Are Hard to Cancel

When you send a Zelle payment online or through your bank’s app, the money usually transfers directly and instantly between bank accounts. Unlike credit cards or PayPal, Zelle isn’t built for disputes or chargebacks.

Before sending, always check:

- Whether the recipient is already Zelle registered

- Your Zelle payment limit

- Which Zelle banks the recipient uses

Knowing these details can help you avoid mistakes that might be impossible to reverse.

When You Can Cancel a Zelle Payment

Most Zelle payments can’t be canceled once they’re sent. However, there are two exceptions:

- If the recipient hasn’t registered with Zelle yet — the payment stays pending until they do.

- If you’ve scheduled a future or recurring payment through your Zelle account — you can cancel before it processes.

If the recipient is already registered, the payment typically completes within minutes, making cancellation impossible.

How to Cancel a Zelle Payment

1. Check if the payment is pending

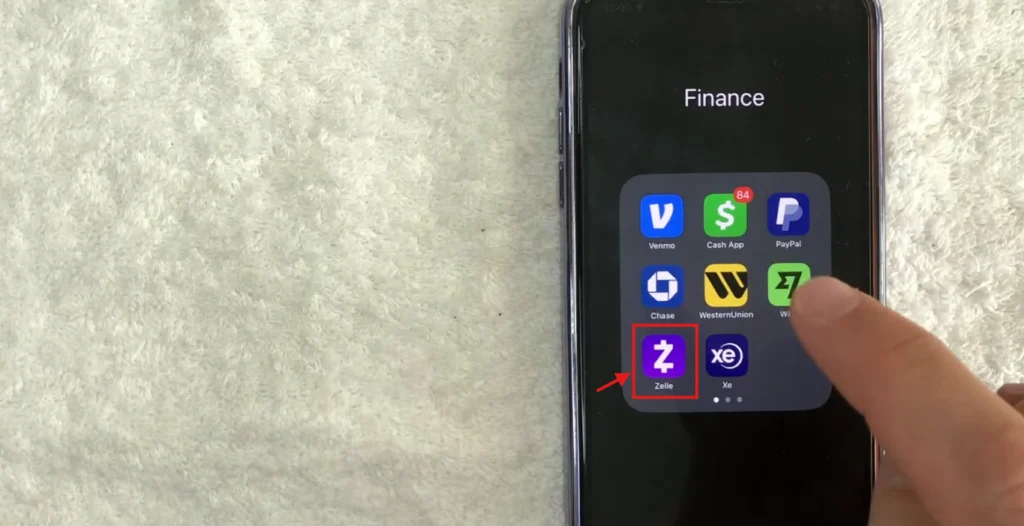

- Open your Zelle payment app or your bank’s mobile app.

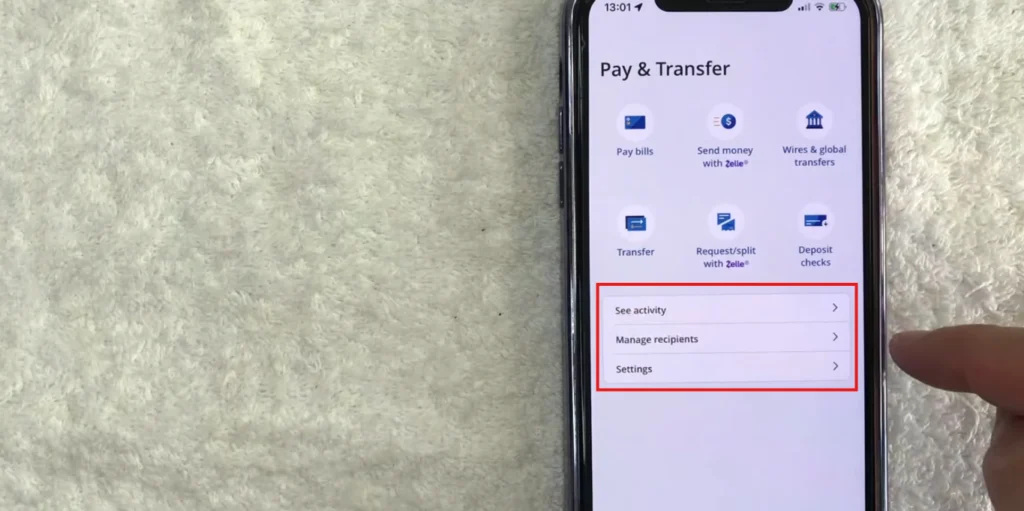

- Go to Activity, Pending payments, or Scheduled payments.

- Find the payment you want to cancel.

2. Cancel the payment

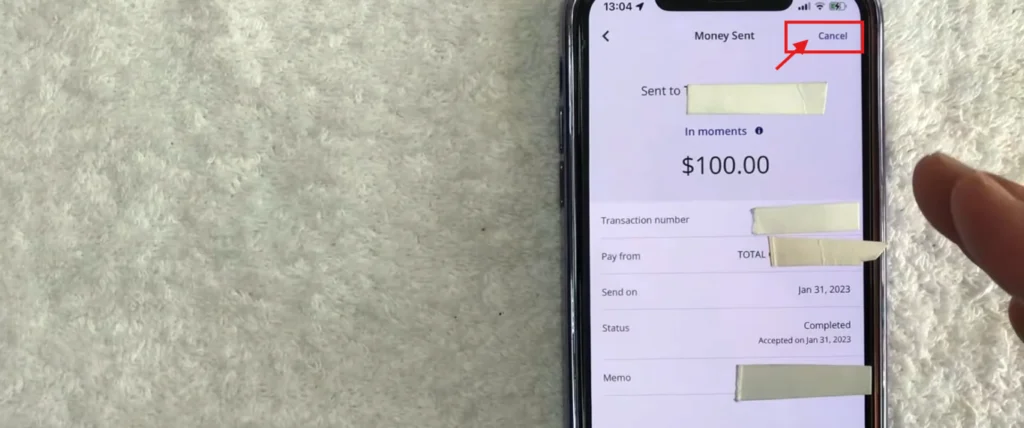

- If the recipient isn’t registered and the payment shows as pending, tap Cancel Payment.

- If it’s a scheduled or recurring payment, select the payment and choose Cancel before the payment date.

What to Do if the Payment Has Already Been Sent

If the recipient is already registered and the payment status shows as completed:

- Contact the recipient directly and ask them to send the money back.

- Immediately contact your bank and Zelle support, especially if it was a mistake or you suspect fraud.

- File a fraud report if you believe you were scammed. Keep in mind that banks and Zelle usually cannot reverse completed payments.

Facts & Figures About Zelle

| Detail | Data |

|---|---|

| Total sent via Zelle in 2022 | $629 billion |

| Number of transactions | ~2.3 billion |

| Instant payment success rate | Over 99% |

Zelle works with hundreds of Zelle banks, which explains why payments are so fast.

Tips to Avoid Future Payment Mistakes

- Double-check the recipient’s email or phone number before sending.

- Know your Zelle payment limit to avoid accidentally sending too much.

- Confirm that the recipient is correctly Zelle registered.

- Use Zelle only to pay people you know and trust.

- Make sure your contacts use supported Zelle banks for faster, smoother transfers.

Frequently Asked Questions About Canceling Zelle Payments

Can I cancel a Zelle payment once it’s sent?

Most payments can’t be canceled because they transfer instantly. You can only cancel if the recipient isn’t yet Zelle registered, or if it’s a scheduled payment.

How do I cancel a pending Zelle payment?

Open your Zelle payment app or bank app, go to Pending payments, select the payment, and tap Cancel Payment.

What is my Zelle payment limit?

Your Zelle payment limit depends on your bank and often ranges from $500 to $2,500 per day. Check your Zelle account settings or contact your bank for the exact limit.

What should I do if I sent money to the wrong person?

Contact the recipient immediately and ask them to return it. Also, contact your bank and Zelle support, especially if the payment may involve fraud.

Which banks use Zelle?

Hundreds of U.S. banks and credit unions are Zelle banks, including Chase, Wells Fargo, Bank of America, and many others.

Is the Zelle payment app safe?

Yes, when used correctly. Always double-check recipient details and use Zelle only to send money to trusted contacts.

Conclusion

Be Careful Before You Tap ‘Send’

The Zelle payment app is incredibly convenient for quick transfers, but its speed means there’s rarely an option to cancel once the money is sent.

To protect yourself:

- Always double-check recipient details.

- Know your Zelle payment limit.

- Use your Zelle account for trusted contacts only.