Introduction

Credit One Bank is a U.S.-based financial institution that offers a variety of Credit One credit cards aimed at individuals building or rebuilding credit. With over 12 million customers as of recent industry reports, Credit One cards have become a popular option due to their relatively easy approval process and features like cashback, fraud protection, and access to the One Bank app for mobile management.

However, many cardholders eventually seek to cancel their Credit One card due to the following reasons:

- High annual fees

- Low credit limits or lack of rewards

- Better alternatives from Capital One, American Express, Wells Fargo, or Discover Financial Services

- Personal financial changes

This comprehensive guide walks you through:

- How to cancel a Credit One card online and by phone

- Refund rules and cancellation fees

- How cancellation impacts your credit

- Best alternative credit cards to consider

Credit One Card Plans & Pricing

| Plan Name | Annual Fee (USD) | Features Included | Ideal For |

|---|---|---|---|

| Platinum Visa | $75 first year; $99/year | Cashback on purchases, credit building | Credit rebuilders, light spenders |

| Credit One Wander Card | $95/year | Travel perks, hotel discounts | Travelers |

| NASCAR Credit Card | $39 – $99/year | NASCAR-related perks, merchandise rewards | NASCAR fans |

Key Pricing Facts:

- Annual fees are billed upfront or monthly, depending on the card

- No free trial period or fee waivers are available

- Users can manage all card functions via the Credit One login portal or mobile app

How to Cancel a Credit One Card

1. Cancel by Phone (Most Reliable)

To permanently close your Credit One credit card account:

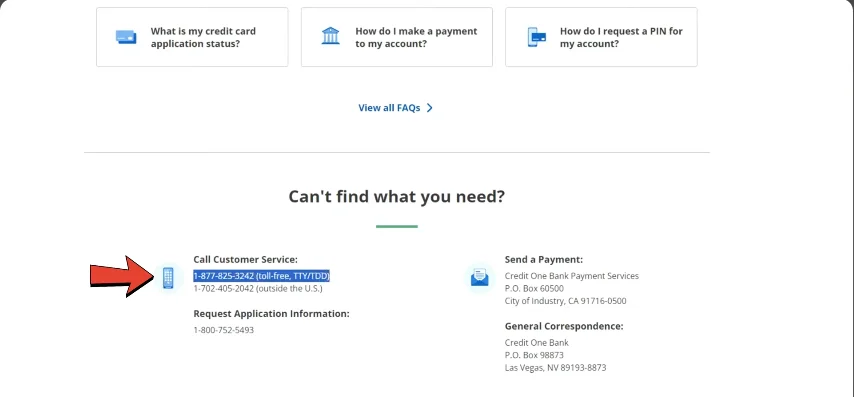

Call Credit One customer service at 1-877-825-3242

Use your account number, ZIP code, and the last four digits of your SSN to verify

Navigate through the IVR by pressing “0” to speak to a live agent

Request: “I want to cancel my Credit One card.”

Confirm you have a $0 balance

Request a written confirmation by mail or email

Note: If you’re abroad, call +1-702-405-2042 instead.

2. How to Cancel a Credit One Card Before Activating

If you haven’t used your card yet, follow these steps to avoid any fees:

Do not activate the card or make any transactions

Call customer service immediately

Request: “Please cancel my Credit One card before activation.”

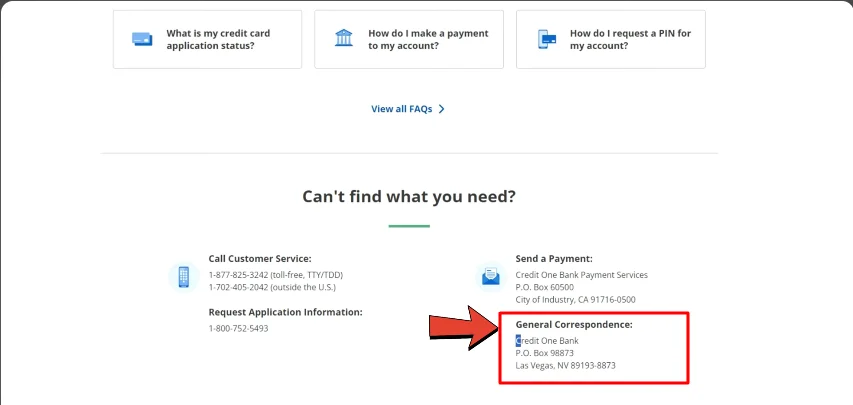

Mail a written request (optional but smart) to:

Credit One Bank

General Correspondence

PO Box 98873

Las Vegas, NV 89193-8873

Include:

- Full Name

- Account Number

- Clear cancellation request

3. Can You Cancel a Credit One Card Online?

Unfortunately, Credit One does not currently allow cancellations via the website or app. But you can:

- Log in to Credit One login portal

- Cancel any active AutoPay or scheduled Credit One payments

- Check for remaining balances or pending transactions

- Message support through Credit One Bank customer service live chat (for basic help only)

Credit One Customer Service Hours

| Contact Method | Availability (PST) |

|---|---|

| Phone Support | Mon-Fri: 6 AM – 9 PM |

| Live Chat (online) | Mon-Fri: 7 AM – 5 PM |

| Physical Mail | 24/7 (reply within 10 business days) |

Is Credit One Bank’s 24-hour customer service available?

No. Plan your cancellation call within the hours listed above.

Refunds, Auto-Renewal & Cancellation Confirmation

- Refund Policy: You may only receive a refund of the annual fee if you cancel before activation or first billing

- If you’ve made even one transaction, the annual fee becomes non-refundable

- Auto-renewal is turned off after cancellation, but you must cancel AutoPay manually

- Log in regularly to confirm the account shows “Closed” and no new charges appear

To double-check:

- Recheck the account status on the One Bank app

- Call support for written confirmation

- Monitor your credit via Credit Karma

What Happens After Cancelling Credit One Card?

Immediate Effects:

- The account is closed immediately upon request

- You lose all card benefits

Impact on Credit:

- Will canceling my Credit One card hurt my credit?

- Yes, possibly. Closure can reduce average account age and increase credit utilization

- Monitor your score post-cancellation

Account History:

- Credit One keeps account data for up to 10 years

- You may request account reopening in rare cases

Best Alternatives to the Credit One Credit Card

Looking for a better fit? Consider the following no-fee or high-reward options:

| Card Name | Annual Fee | Features | Apply Here |

|---|---|---|---|

| Capital One Quicksilver | $0 | 1.5% cash back, generous limit increases | https://capitalone.com |

| Discover It Secured | $0 | Cashback + credit-building tools | https://discover.com |

| Petal 2 Visa | $0 | No credit score needed, high limits | https://petalcard.com |

| Wells Fargo Active Cash | $0 | 2% unlimited cashback | https://wellsfargo.com |

| American Express Blue Cash | $0 first year | Strong global acceptance + cash back | https://americanexpress.com |

Discover Financial Services and Capital One remain strong options for rebuilding credit with better perks.

FAQs – Cancellation Process & Policies

How can I cancel my credit card online?

Most issuers, including Credit One, do not allow online card cancellation. You must call or mail a request.

What is the cancellation fee for OneCard?

There is no specific cancellation fee, but you forfeit any unused annual fee if the card has been used.

Will canceling my Credit One card hurt my credit?

It can lower your score due to changes in account age and credit utilization. Use Credit Karma to monitor.

How to permanently close the OneCard credit card?

Call Credit One, ensure your balance is $0, and request written confirmation of account closure.

How to cancel a Capital One card?

Call Capital One customer service at 1-800-227-4825 or use the My Capital One app.

Conclusion

Canceling your Credit One card in 2025 requires:

- Settling your full balance

- Calling customer service

- Manually stopping AutoPay

- Requesting a written confirmation

There is no way to cancel via the website or mobile app. Cancel early to avoid non-refundable annual fees. Once closed, explore better card options from Capital One, American Express, or Discover.