Introduction

Starting a Limited Liability Company (LLC) in California offers flexibility, liability protection, and business credibility. But if your venture is done, it’s important to formally cancel your LLC to avoid future taxes and penalties.

This guide explains how to dissolve an LLC in California online in 2025 using Bizfile California, how to file the right forms with the California Secretary of State (SOS CA), and how to confirm your certificate of cancellation (Form LLC-4/7) has been processed.

We’ll answer questions like:

- How do I close my LLC in California?

- How much does it cost to cancel an LLC in California?

- What steps are required to officially dissolve an LLC?

LLC Dissolution: Costs and Basics

| Requirement/Fee | Amount (USD) | Description |

|---|---|---|

| Franchise Tax (Yearly) | $800 | Required until official cancellation is filed |

| Filing Fee (Form LLC-4/7 or LLC-4/8) | $0 | No fee to file with CA Secretary of State |

| Certified Copy (Optional) | $5 | Get official proof of cancellation from the state |

| Drop-off Priority Fee (Optional) | $15 | Same-day hand-delivery service in Sacramento |

Note: First-year LLCs may be exempt from the $800 franchise tax if cancelled within 12 months and no revenue was generated. See Franchise Tax Board for details.

Step-by-Step: How to Cancel an LLC in California

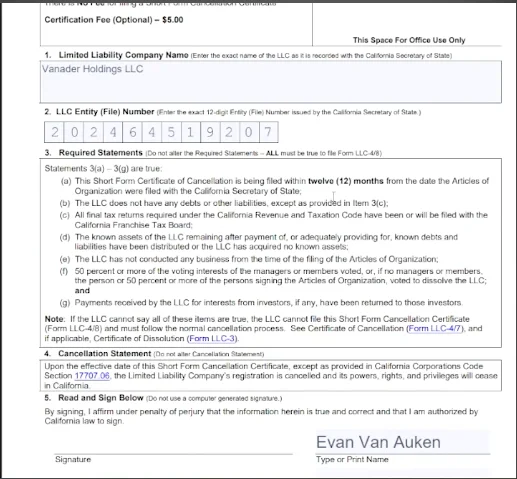

Step 1: Choose the Correct Cancellation Form

Use the right form depending on your LLC’s age and activity:

| Form | Use Case | Link |

|---|---|---|

| Form LLC-4/8 | Short-form cancellation for LLCs < 12 months old, no activity or debts | Download Form LLC-4/8 |

| Form LLC-4/7 | General certificate of cancellation (used most commonly) | Download Form LLC-4/7 |

| Form LLC-3 | Certificate of Dissolution (if not all members consent to cancel) | Download Form LLC-3 |

Step 2: File Final Taxes

Before submitting your cancellation:

- File a final tax return with the Franchise Tax Board (FTB)

- Mark it as “Final Return” on Form 568

- Pay any outstanding franchise taxes

Learn more from the California FTB LLC page.

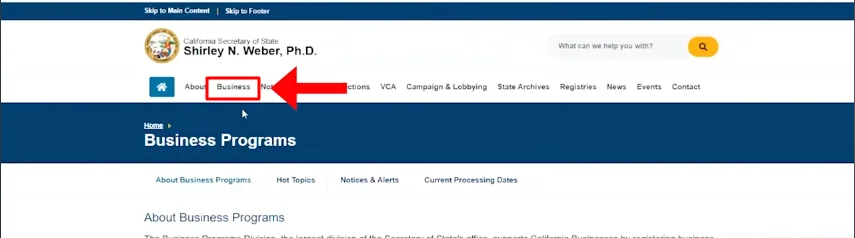

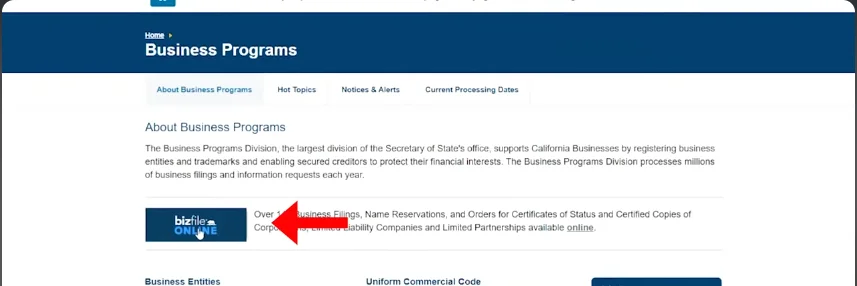

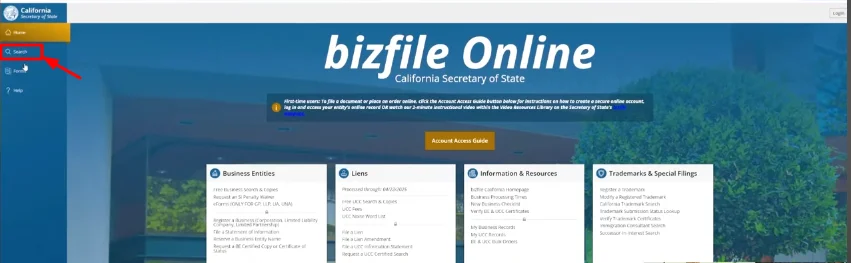

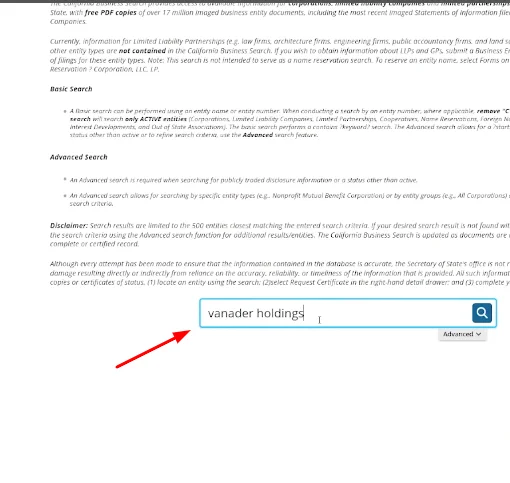

Step 3: Submit Forms via Bizfile California

You can file forms online using the official Bizfile Online Portal:

Online Filing Instructions:

Go to Bizfile California

Click “File Amendment” under your LLC

Choose “Terminate LLC.”

Upload Form LLC-4/7 or LLC-4/8

Sign digitally and submit

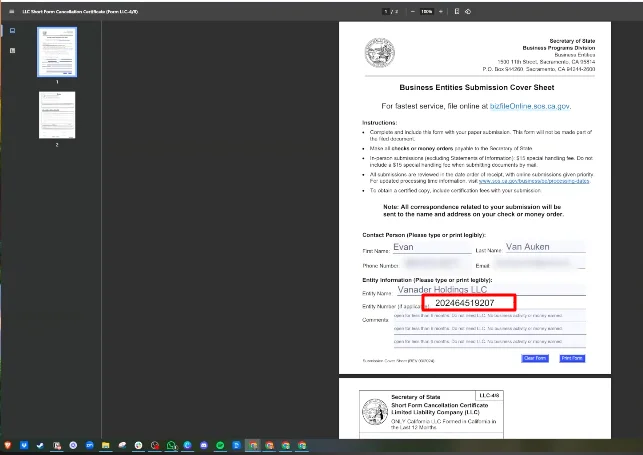

For paper filing:

Mail your completed forms to:

California Secretary of State

Business Entities – Processing Unit

P.O. Box 944260

Sacramento, CA 94244-2600

Phone: (916) 653-6814

Email: bizfile@sos.ca.gov

You may also drop off in person at:

1500 11th Street, Sacramento, CA 95814 (Business Programs Division – 3rd Floor)

What Happens After You Cancel?

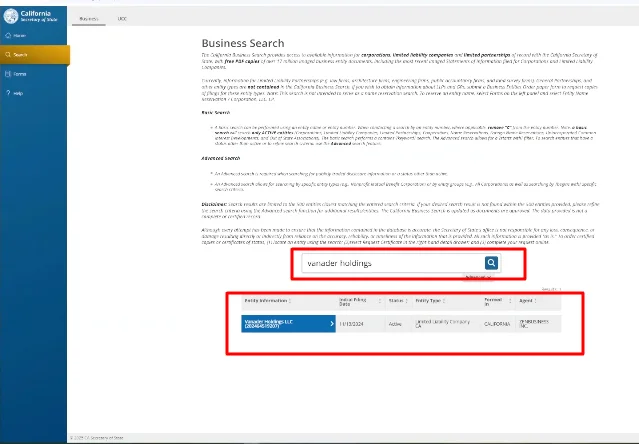

Once the California Secretary of State accepts your certificate of cancellation (Form LLC-4/7):

- Your LLC’s powers and privileges are officially revoked

- You will no longer owe franchise taxes for future years

- The cancellation status will show in the Business Search Tool

Keep all certified copies and tax documents for at least 7 years.

Alternatives to LLCs

If you’re shutting down due to complexity or cost, consider alternatives:

| Structure | Cost (CA) | Liability Protection | Admin Burden | Good For |

|---|---|---|---|---|

| Sole Proprietorship | Minimal | None | Very low | Freelancers, consultants |

| General Partnership | Low | Shared | Low | Small teams |

| S Corp | $800+ | Yes | Moderate | Growing businesses |

For easier structures, visit IRS Entity Types.

FAQs – California LLC Cancellation

How do I officially close an LLC in California?

- File final taxes

- Submit Form LLC-4/7 via Bizfile California

- Confirm with the CA Secretary of State using the business entity lookup

How much does it cost to cancel an LLC in California?

- Filing is free

- Certified copies cost $5

- The optional drop-off priority fee is $15

Can I dissolve my California LLC online?

Yes, use Bizfile Online for fast processing.

What is the difference between Form LLC-4/7 and Form LLC-3?

- LLC-4/7 is the main certificate of cancellation

- LLC-3 is the certificate of dissolution – needed only if not all members agreed to cancel

Conclusion

If you’re no longer doing business in California, don’t skip formal cancellation—it saves you from paying extra franchise tax or being penalized. Follow these steps:

- File final taxes

- Choose the correct form (LLC-4/8, LLC-4/7, or LLC-3)

- Submit it via mail or Bizfile Online

- Confirm cancellation and keep records

Need certified proof? Pay $5 when you file. Got questions? Reach out to:

California Secretary of State

Phone: (916) 653-6814

Email: bizfile@sos.ca.gov

Official Site: https://www.sos.ca.gov/

Related Articles

- How to Cancel Sling TV Subscription

- How I Cancelled My Dropbox Subscription

- How to Cancel Your iCloud+ Plan